Recommended Advice To Selecting Britannia Gold Bullion

Wiki Article

What Should I Consider When Purchasing Gold Bullion And Coins In Czech Republic?

Tax Implications: Learn about the tax implications of buying and selling Gold in the Czech Republic. The investment in gold could lead to different tax laws which can affect your returns. Market Conditions- Keep track of market trends and fluctuations in the gold price. This will allow you make a more informed decision on the best time to invest.

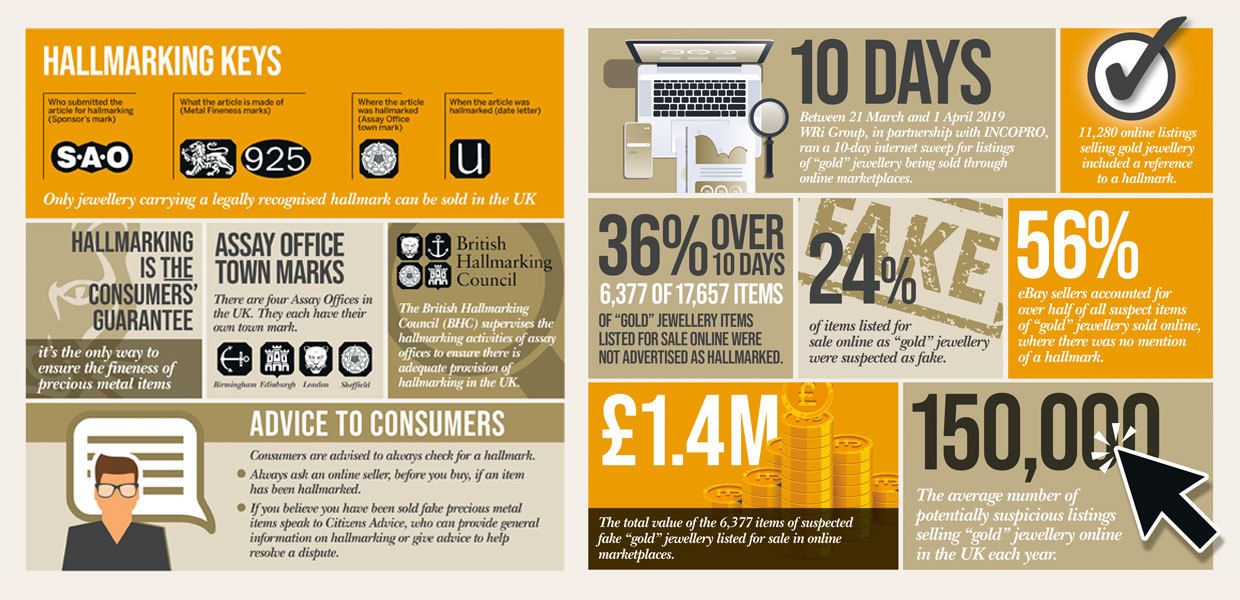

The authenticity of the Gold Bullion as well as Coins- Make sure to ensure that any gold coins you buy are authentic and include all documentation required.

Purpose of Investment- Clarify your investment goals. It is important to decide if you'd like to purchase gold as a longer-term investment, to diversify your portfolio or to protect against inflation.

Consultation and Research - Talk with financial advisors regarding precious metals and investing. Make smart investments by conducting extensive research into the gold market.

Remember that while gold can be a great asset It is important to approach all investments, including precious metals, with careful consideration, research, and a clear understanding of your financial objectives and the risk-taking capacity. Take a look at the top rated buy Maple Leaf Gold for site examples including double eagle gold coin, price for one ounce of gold, gold sovereign coins, gold quarter, gold sovereign, gold sovereign, buy physical gold, gold doubloons, $50 gold coin, gold exchange traded funds and more.

How Do I Know Whether The Gold I Purchase Is Authentically Documented And Has Certificates Of Authenticity?

Follow these steps in order to make sure you are buying gold with proper documentation, which includes certificates of authenticity.

Ask the seller - You must inquire directly with the seller or dealer for documents. Most reputable sellers will provide certificates of authenticity and assay certificates in addition to the purchase. Request Specific Information - Request details on the documentation. Certificates should provide specifics about the gold item, like its purity (in karats or fineness) and weight, as well as the manufacturer's name or hallmark, as well as any other relevant details.

Check all documents or Certificates. Inspect them carefully. Verify that they include the information of the seller, the date of their sale, and any seals, official stamps, or stamps that verify their authenticity.

Cross-check the Information - Compare the information in the certificates against the gold itself. Verify that the hallmarks or purity marks that appear on the piece match those in the certificate.

Check the legitimacy of the source - Examine if the entity issuing the certificate or the authority that is listed in it has a great reputation. Make sure that the assay office is a government institution or reputable certification agency. Follow the top rated their explanation on gold price Maple Leaf for website examples including gold bullion coins, krugerrand, sd bullion gold, 1979 gold dollar, gold mining stocks, gold mining stocks, gold and silver bullion, 100 grams gold biscuit, gold one dollar coin, 2000 dollar coin and more.

What Is A Low Price Spread And How Is It A Markup Of The Price Of Gold On The Stock Exchange?

Low price spread and the term "low markup" are used in the context of gold trade to refer to costs associated with purchasing or selling gold based on the market price. The terms are used to describe the amount of amount you might have to pay (markup), or the difference in price between the selling and buying price (spread) that is greater than the price of gold that is market-value. Low Markup- This means that the dealer charges only a minor cost over market value. A low mark-up implies that you'll be charged a price that is similar to its current value or slightly higher.

Low Price spread- The price spread is the difference between the selling and buying prices (ask and bid) for gold. A spread that is low signifies a smaller gap between these prices, which means there's less of an asymmetry between the price at which you are able to purchase gold and the price that you can sell it.

How Much Do Mark-Ups And Price Spreads Vary Across Different Gold Dealers?

Here are some general observations about the variations: These are some general considerations regarding the variations. Dealer Reputation and Service Quality- Reputable, established dealers could charge higher mark-ups based on their perceived reliability, quality and service. Conversely, newer or less-established dealers might have discounts to lure customers.

Business Model and Overhead Costs- Dealers with physical storefronts or premium services could have greater overhead costs, leading to higher mark-ups in order to cover these expenses. Sellers on the internet or who are operating at a lower cost could have a lower price.

Pricing Transparency - Dealers who offer transparent pricing typically provide lower markups and less spreads in order to attract clients who are looking for honest and transparent pricing.

It is essential for buyers, considering these aspects, to do extensive study, compare prices and consider other aspects like reputation, reliability and customer support when choosing a vendor. A quick search and comparison of quotes from various sources can help identify competitive prices for gold purchases. See the top rated funny post for buy Charles III Gold for blog recommendations including purchase gold bullion, canadian gold maple leaf coin, gold and silver shops near me, sell gold coins, gold ira best, 1972 gold dollar, best way to buy gold, gold apmex price, gold bullion coins, gold stocks to buy and more.